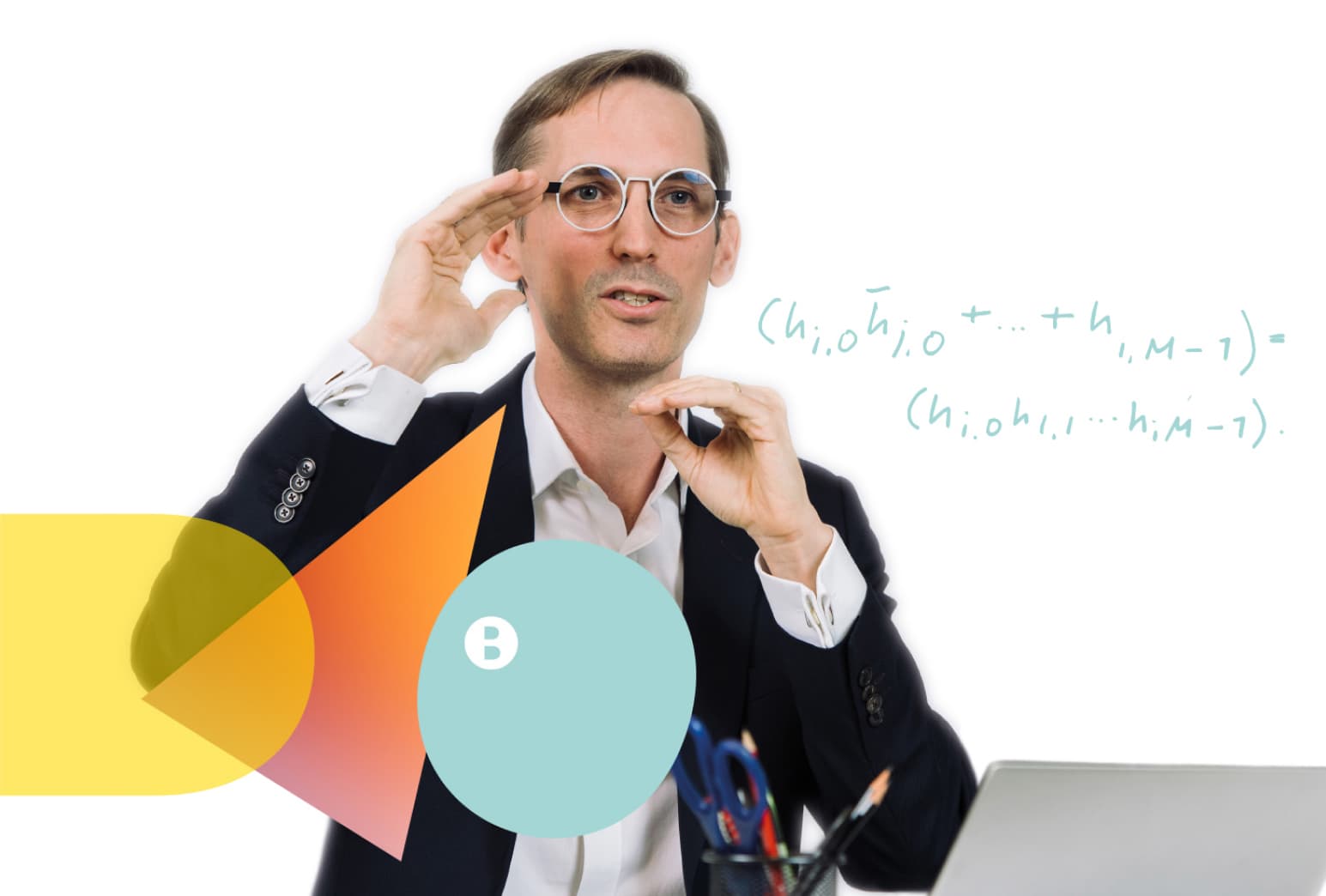

Through inquisitive minds

An independent approach to litigation, transactions and advice throughout the world

Core sectors

Who we are

Legal expertise joined up with science and technology backgrounds means we understand your business and can talk the same language